The market for protein foods and supplements has become intensely competitive. Brands are launching new formulas, unique flavors and premium packaging at a rapid pace. For product teams, marketers and founders the key question is this: what drives purchase decisions and loyalty in the market?

Answering that question requires listening to customer sentiments at scale and turning unstructured opinions into clear, strategic signals.

This article provides an overview based on the analysis of more than 8,000 customer reviews collected across Amazon, Target, brand e-commerce sites and Reddit.

The market for dietary supplements

Recent market estimates place the global protein supplements market in the tens of billions of dollars, with multiple reports projecting continued high growth over the coming years. One estimate valued the market at roughly USD 28 billion in 2024, with forecasts that place the category well above USD 30 billion in the near future. (Fortune Business Insights)

Consumers are eating more protein for overall health, fitness goals and convenience, while also showing increased interest in product attributes such as ingredients, flavor variety and sensory experience. These dynamics mean that product sensory performance and perceived product quality are central to brand differentiation. (Cargill)

What drives consumer decisions?

The practical question that motivated this work was simple: what aspects of protein powder products truly dominate customer conversations and decision-making? And what is the sentiment associated with those aspects? If brands know the two or three attributes customers care about most, they can prioritize R&D, packaging and campaigns.

A market research of protein powders

This study develops in 4 main steps:

- Data collection. Scrape and aggregate public reviews so the sample reflects mainstream channels customers use to research and buy protein powders.

- Data preparation. Clean and normalize the review texts.

- Text analysis. Apply unsupervised clustering to find natural groupings, calculate aspect mention rates and measure sentiments.

- Summary. Combine frequency and sentiment signals to propose business actions and priorities.

Data sources

Using Python and Selenium I scraped public consumer reviews from major retailers and community platforms. The final dataset comprised more than 8,000 reviews from Amazon, Target, several brand storefronts including flagship e-commerce stores and Reddit threads.

Data preparation

I used Pandas to normalize fields, remove duplicates, unify text encoding and trim junk tokens. The objective of the preprocessing step is ensuring the review text is a representation of what customers actually say, which includes preserving product-specific words (flavor names, ingredient terms), cleaning punctuation and normalizing whitespace.

Natural language processing (NLP)

For the core text analysis I used NLTK for tokenization, CountVectorizer and TF-IDF from scikit-learn and VADER for lightweight sentiment scoring tuned to short consumer text.

What 8,000 reviews unveiled

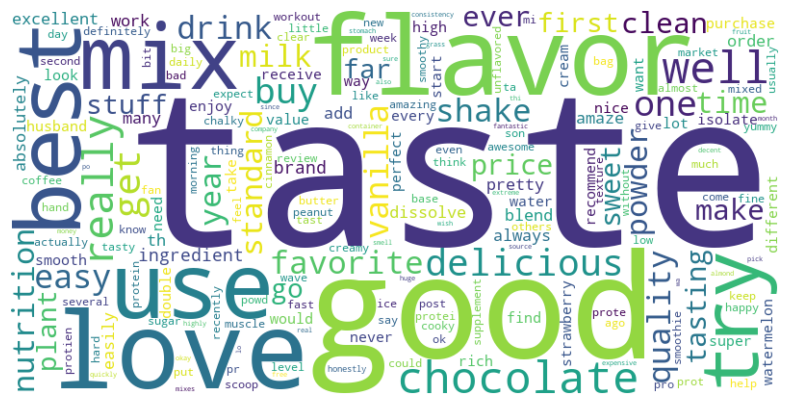

Topic analysis

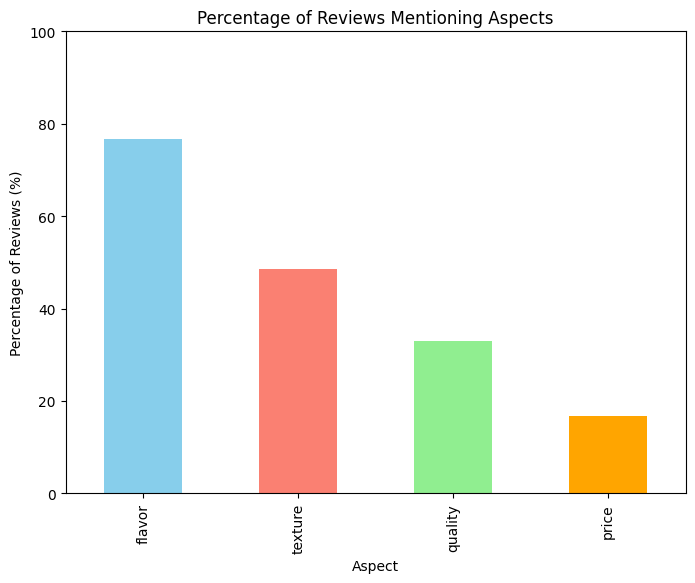

Across the full sample the analysis identifies four customer aspects that dominate discussion: flavor, texture and mixability, perceived product quality and price/value. The raw figures are:

- Flavor: 76.78% of reviews mentioning the aspect.

- Texture: 48.69% of reviews mentioning the aspect.

- Quality: 32.94% of reviews mentioning the aspect.

- Price: 16.79% of reviews mentioning the aspect.

These results show that flavor is by far the most frequently discussed attribute, followed by how the product mixes or feels in the mouth. Quality-related terms (ingredients, naturalness, sweeteners) are mentioned by about a third of reviewers. Price shows up less often but is still relevant to a minority. These counts are the basis for strategic prioritization: a product that fails on flavor or mixability will frustrate the majority of buyers, while price and ingredient concerns tend to be secondary decision filters.

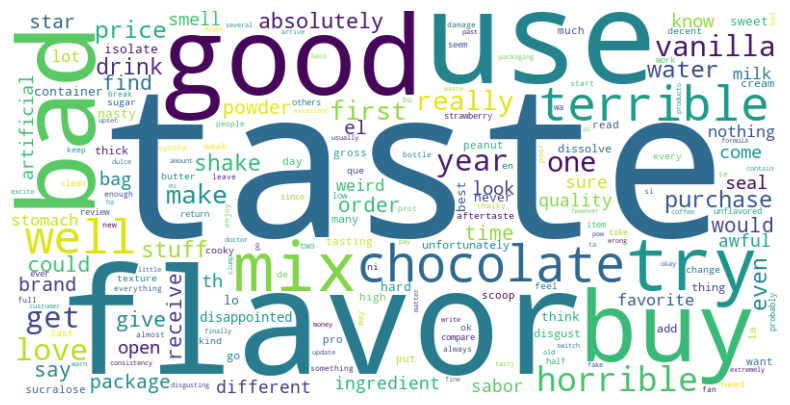

Topic sentiments

Measured with VADER compound scores aggregated over reviews that mention the aspect, below you’ll find average sentiment values. The scale used ranges from -1, absolute negativity, to 1, absolute positivity in the review.

- Flavor-related reviews: 0.6446

- Texture-related reviews: 0.6787

- Price-related reviews: 0.5908

- Quality-related reviews: 0.6604

Interpretation

There are two important observations here. First, flavor and mixability dominate the conversation. Second, where customers talk about these attributes they are, on average, positive. Positive sentiment on flavor and texture apparently means that good formulations get recognized and rewarded, and that sensory performance is a reliable point of differentiations. Quality mentions also show positive sentiment, indicating that naturalness and healthiness can support premium positioning when credible.

Bottom line: Flavor and solubility driving customer choices

The combination of high prevalence and positive sentiment for flavor and mixability is a clear strategic signal. Investors and brands often assume price or protein content are the dominant purchase drivers. The data shows that while those things matter, sensory performance is the first consumer test. If a product does not taste good or poorly mixes, the likelihood of repeat purchase and positive advocacy falls dramatically.

Business recommendations

Product and R&D

- Prioritize sensory R&D. Flavor and mixability are the leading purchase determinants. Hence, invest in flavor and solubility testing.

- Build flavor architecture intentionally. Use tiered flavor strategies: a core set of mass-appeal flavors to drive trial and limited-edition releases to attract higher-intent consumers and social buzz.

- Use ingredient messaging to support premium pricing. Where ingredient claims are true and differentiating, reference these boldly in product copy and packaging.

Marketing and brand

- Lead with sensory proof in campaigns. Ads that emphasize how the product tastes and mixes, show real user pours and quick mixing moments, and include short testimonials will convert better than claims about macro composition alone.

- Make “mixability” a trust signal in product pages. For example, a video of a scoop being mixed in water and a one-line “no lumps”.

Limitations

- Although the dataset spans multiple channels, review samples are not a perfect representation of the total buyer population.

- Reviews overrepresent highly satisfied and highly dissatisfied customers. To reduce bias, I used multiple sources and combined frequency and sentiment measures rather than relying on absolute counts.